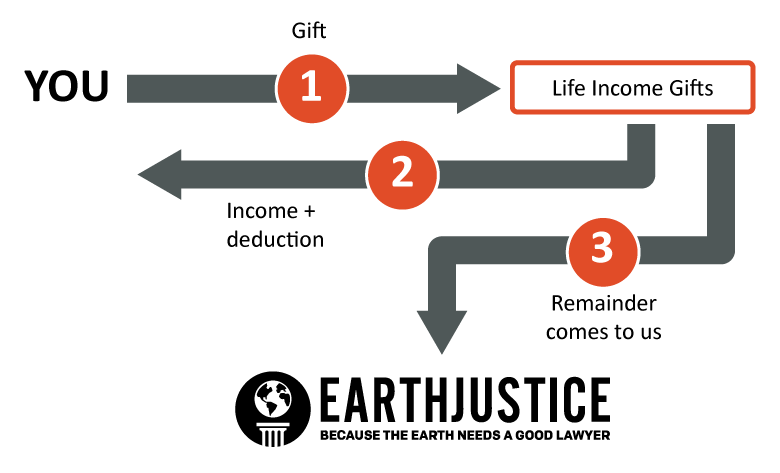

You can generate income for yourself and a loved one, all while ensuring our work to defend a healthy environment for future generations.

If you’re considering one of these gifts, we recommend consulting with Earthjustice and your financial partner to select the gift that’s right for you.

Charitable Gift Annuities

Charitable Gift Annuities (CGAs) are a great way to support Earthjustice while generating income for yourself and your family.

You can donate cash or securities worth $10,000 or more to Earthjustice and receive fixed annual payments for life in return. Many supporters like charitable gift annuities because of their attractive payout rates and their significant impact.

How it works:

- You donate cash or appreciated securities worth $10,000 or more to Earthjustice. In return, you and/or another beneficiary will receive fixed payments for life.

- Your payment rate is based on your age (payments start at age 60 or later) and will never change.

- A portion of your payments will be tax-free.

- The older you are — or the longer you defer starting your payment — the higher your payments will be.

Benefits to you include:

Lifetime payments that will never change.

You may avoid some capital gains tax when you use appreciated stock to fund your gift annuity.

You may be eligible for an income tax deduction for the year you make your donation.

Gift annuities are an ideal way to provide financial security for you and a loved one.

You create your environmental legacy.

View Examples

Immediate Payment Gift Annuity:

If Helen, age 70, establishes a $50,000 charitable gift annuity with Earthjustice, her payment rate will be 6.3%. She will receive an annual payment of $3,150 – for the rest of her life!

In addition, she can save on taxes two ways. She is eligible for a charitable income tax deduction of about $20,083. And, if she funds her gift with stock with a low-cost basis, a portion of her capital gain will never be taxed.

Deferred Gift Annuity:

If you don’t need the income immediately or you have not reached age 65, you can schedule payments to begin at least one year after your donation or once you reach age 65. The longer the deferral period, the higher your payment rate.

Jane, age 63, has had a successful career. In fact, she loves it so much that she plans to continue working until she’s 70. At that time, she will welcome the additional income from a $75,000 Earthjustice gift annuity.

Jane’s payment rate at age 70 will be 8.6% and her fixed annual payment will be $6,525, a nice supplement to her retirement income. A portion of her payment will be tax-free and she will be eligible for an immediate income tax deduction of about $37,216.

Charitable Remainder Trusts

You can donate cash or appreciated assets to Earthjustice and receive payments for life, or for a fixed number of years, in return.

How it works:

- You transfer cash or an appreciated asset* into an irrevocable trust.

- The trustee then sells the asset, paying no capital gains tax, and reinvests the proceeds.

- For the rest of your life (or a term of years), you and/or another beneficiary receive payments from the trust.

- After your lifetime, the remaining principal is used to support the mission of Earthjustice.

Benefits to you include:

You avoid paying capital gains taxes on sales of appreciated assets.

You convert the full value of these assets into a lifetime income stream.

You create your legacy of victories for the environment and human health.

View Example

Evelyn and Paul, both age 72, would like to increase their retirement income. Paul also wants to make sure that Evelyn has more than enough income to live on even if she needs long-term care someday. After discussions with Earthjustice staff and their advisors, Evelyn and Paul decided to create a 5% charitable remainder trust funded with $1 million in Paul’s highly appreciated company stock. Paul can rest assured knowing that Evelyn will have an additional $50,000 a year in retirement income. Additionally, they were able to remove $1 million from their taxable estate and avoid significant capital gains taxes.